Private Alternatives

Private Investment

Private investments are a financial asset outside of public market assets such as stocks, bonds, and cash. They offer options for investors looking to diversify their portfolios from traditional stocks, bonds, and other publicly traded securities. Qualified investors often access private investments through an investment fund. Examples of private investment fund sectors include private credit, private real estate, private equity, and private infrastructure.

Who uses Private Assets

- ONTARIO TEACHERS’ PENSION PLAN (69%) 69%

- ONTARIO MUNICIPAL EMPLOYEES’ RETIREMENT SYSTEM (62%) 62%

- US ENDOWMENTS (52%) 52%

- CANADA PENSION PLAN INVESTMENT BOARD (50%) 50%

- ULTRA HIGH NET WORTH (46%) 46%

- HIGH NET WORTH (22%) 22%

- RETAIL INVESTORS (5%) 5%

Source: Frontier Investment Management – Investing Like The Harvard and Yale Endowment Funds

Private Credit

What is Private Credit?

Private Credit is broadly defined as negotiated loans that take place outside of the traditional bank network and are held by private companies. Being able to provide investors with more senior secured positions in the capital stack has made private lending an attractive option for portfolio diversification.

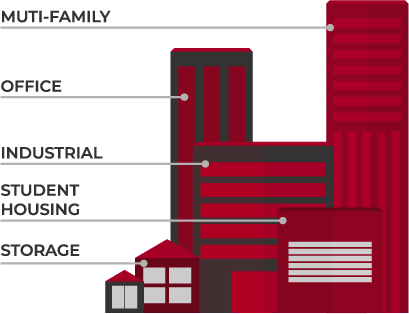

Private Real Estate

What is Private Real Estate?

Private real estate offerings come in a variety of strategies and structures and typically involve income-generating properties such as residential, storage, and industrial buildings. These investments can offer investors a range of benefits, such as capital growth, stable cash flows, and access to select real estate opportunities that are not available otherwise.

Private Equity

What is Private Equity?

While investors gain equity in a business by buying its shares on a stock exchange, they can also gain equity in a private business outside the stock exchange. By investing in private equity, investors can access a wide field of investment opportunities not typically offered in public markets.

Private Infrastructure

What is Private Infrastructure?

Private infrastructure investments come in a variety of strategies involving income and capital appreciation objectives. Infrastructure assets include renewable energy, digital infrastructure, cell phone towers, transportation & logistics, utility related services, airports, toll roads, and waste removal.