Advisory Services

We view ourselves as a part of your family’s financial future

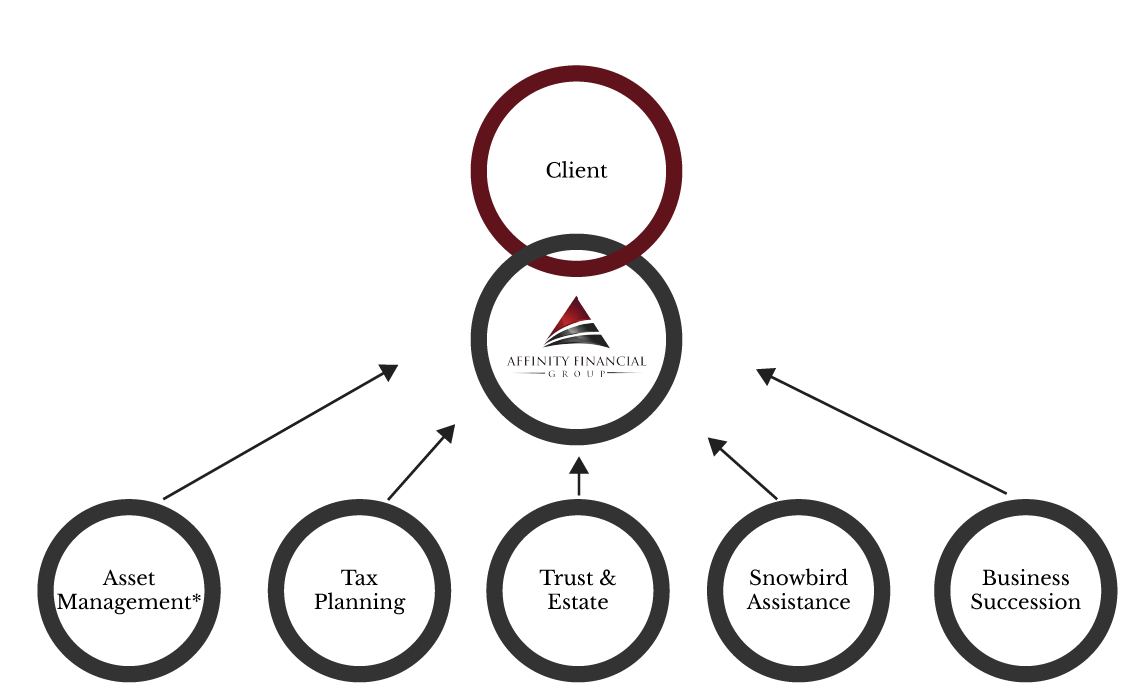

We offer comprehensive wealth management and a network of professional advisors including accountants, tax specialists, lawyers, and trustees.

Affinity understands the importance of having your professional advice integrated. Integrated strategies that connect tax, investment, and legal advice inevitably achieve optimal results. The best way to accomplish this is to hire a group of experts and professionals to handle a majority of your financial needs under one roof. If your goal is to simplify, we are here to help. We offer Investment and Advisory expertise in house while we have access to outside resources as required.

Affinity Multi Family Office

Affinity Financial Group’s premiere service offering designed to simplify the most complex financial lives.

* Best Serving Families with liquid assets in excess of $5 Million and/or in excess of $10 Million total net worth.

A multi family office is a dedicated multi disciplinary team of professionals who look after your family’s complex financial and human capital needs. The family office oversees and manages your financial affairs and maintains your financial information and records. It provides customized services and supports the family to sustain and grow wealth. We do this by maximizing your financial resources through integrated planning; providing peace of mind that financial opportunities and priorities are being taken care of; helping you to articulate your family values to create the best financial and non-financial legacy. Your family can rely on a dedicated team of multi-disciplinary professionals with Affinity Financial Group.

*Certain resources will be outsourced.

Affinity Private Wealth

The Affinity Private Wealth offering elevates the level of execution and performance related to your financial affairs. Clients are often seeking a more integrated and comprehensive approach to planning along with a higher level of portfolio design.

* For Qualified families and individuals.

* Best Serving Clients between $1-$5 Million of Liquid assets.

Affinity Private Wealth Clients are often experiencing the challenges of accumulated wealth. They are looking to upgrade into a more integrated and customized approach to wealth management that better reflects their affluence. They seek a more appropriate portfolio design and a higher level of organization related to their financial lives.

Affinity Accumulation

Very few individuals or families start with excessive wealth. Most must endure the hard work / accumulation phase of building wealth

* Best Serving Clients between $250,000 – $ 1 Million of liquid assets and those with high incomes or strong aspirations for their financial future.

Affinity’s team can provide expert guidance to set you on the right path. Our scale allows us to offer solutions that might not otherwise be available at this stage of your financial life.