Asset Management

The Institutional, Family Office, Ultra High Net Worth Investor Strategy.

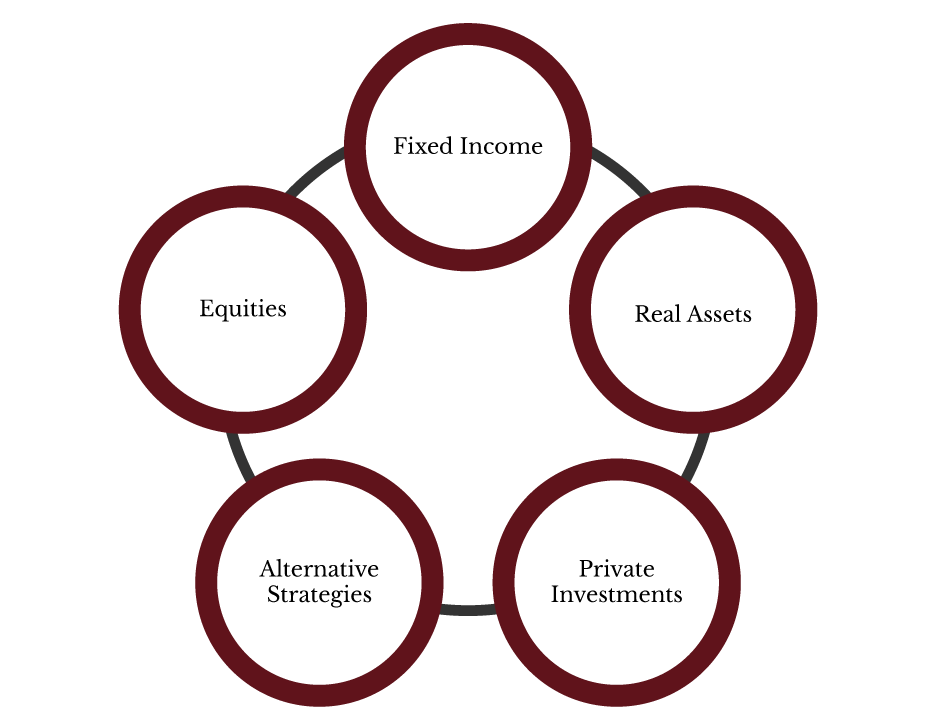

Our approach combines the sophistication of Institutional, Family Office, and Ultra High Net Worth investors, with the personal touch of boutique wealth management. For the past several decades, major institutions have been utilizing private investments in combination with public stocks and bonds as a method to reduce volatility and enhance returns.

Our clients graduate into institutional asset allocation strategies including one of a kind diversified pools of Private Real Estate, Private Credit, Private Infrastructure and Private Equity.

Our ultimate goal is to generate consistent, predictable portfolio returns while maintaining a balance between fees and performance. In order to do so, we will use a blend of ETFs (Exchange Traded Funds), individual securities (stocks and bonds) along with mutual funds, and allocations to provide securities and alternative investments.

Strong net of fees performance and risk management is the ultimate goal. We assess all investment options available from all financial institutions to achieve this outcome.

Private Alternatives

Private investment, also commonly referred to as an alternative investment, is a financial asset outside public market assets such as stocks, bonds, and cash.

Liquid Alternatives

Many liquid alternative strategies seek to offer a positive “absolute return” that doesn’t depend on a general upward direction in stock and/or bond markets.

Public Equity

Public Equity is arguably the most common and recognized asset class in an investor’s portfolio. Effectively, public equity is the stock market.

Public Fixed Income

Public Fixed-Income is traditionally known as the lower volatility segment of a client portfolio and entails the largest public asset market in the world.